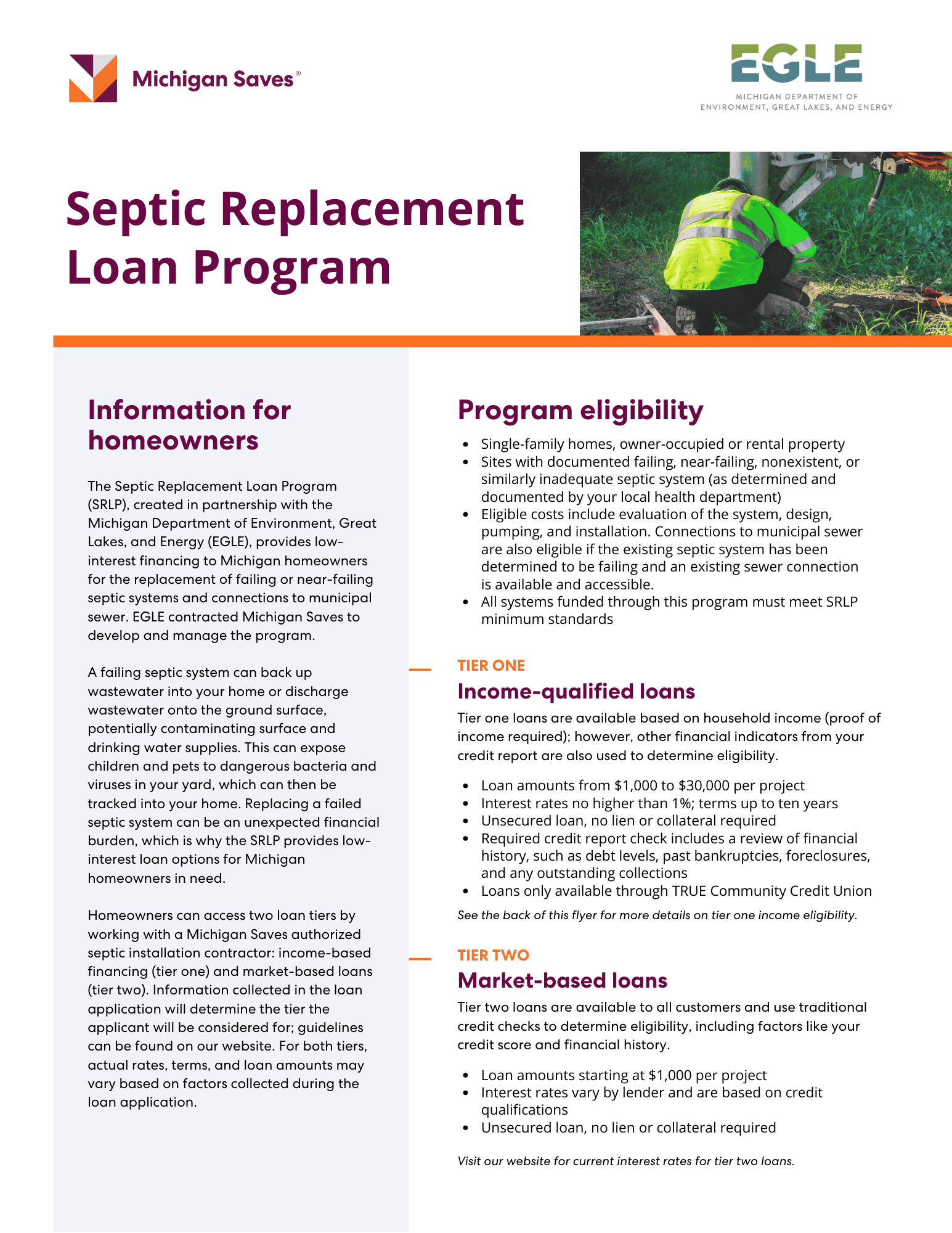

The Harrington Apartments on West Grand Boulevard in Detroit is one of three multifamily buildings that Southwest Housing Solutions recently retrofitted with energy efficiency improvements. (Photo courtesy of Southwest Housing)

Basics of Financing Multifamily Improvements with Michigan Saves

Amount: $2,000 to $250,000 per property

Terms: 24 to 60 months is standard, but up to 84 months are allowed for those with good credit

Interest rates: Range from 6 percent to 10 percent

Application: Single page, plus two years of financial background documents

Fees: Documentation fee of $250 paid to a Michigan Saves authorized lender

Eligible properties: Any multifamily housing of two or more dwellings

Dan Pederson and Southwest Housing Solutions in Detroit are keen on green energy. As a nonprofit committed to neighborhood revitalization, Southwest Housing also is keen to help its tenants stay up with their utility bills.

In the end, though, the motivation for Southwest Housing to do energy retrofits on three of its buildings (the Cole, Harrington, and Harwill) was the other kind of green—dollars.

“We were looking at what kind of expenses we were going to incur over the next five to 10 years … and how some of those expenses might be covered,” Pederson explains.

Southwest Housing spent about $300,000 on the properties near West Grand Boulevard and Vernor Highway in Southwest Detroit to erect new white roofing to reflect summer sunbeams, replace kitchen appliances and hot water tanks, and plug cracks in brick facades and air leaks around doors and windows. Pederson is confident that these measures have reduced energy costs for Southwest Housing and the affected tenants, though he’s not sure the latter have noticed.

“Honestly, [tenants’] greatest excitement was getting a new stove, not $10 or so in savings on [utility] bills,” Pederson says.

Southwest Housing’s experience reflects both the tantalizing opportunities—and frustrating challenges—of bringing energy efficiency improvements to the multifamily housing market.

Nearly a third of residents in the United States are renters, according to the National Multifamily Housing Council. In Michigan, multifamily housing accounts for 18 percent of the total housing stock, or 815,000 units, according to the 2012 American Community Survey.

And those numbers are likely to rise.

In response, Michigan Saves has launched a program for energy efficiency loans targeted to the multifamily market. The program is designed to overcome several specific barriers that have historically made it difficult to secure financing for energy efficiency improvements in this sector, said Terri Schroeder, operations manager for Michigan Saves.

Easier financing equals bigger projects, more savings

Michigan Saves coordinates and connects contractors and lenders. Michigan Saves has built up and trained a statewide corps of contractors who can handle the most advanced energy retrofit projects for a variety of structures. Michigan Saves’ partner, Capital Fund Services Inc., manages the loan loss reserve, which reduces the risk for lenders in the multifamily market. Finally, Ascentium Capital, our participating lender, joined the effort by extending longer-than-typical terms, thereby making more energy retrofit projects financially feasible for multifamily building owners.

By linking contractor expertise to customer demand to flexible loan terms, Michigan Saves is able to overcome many of the traditional hurdles to energy investments in this sector.

“The multifamily sector always struggles with split incentives, for example, where the landlord has to finance the upgrades that the tenant benefits from, so the landlord has less of a direct financial incentive to act,” explains Schroeder.

Southwest Housing, in fact, faced that very conundrum in its own analysis. The nonprofit pays the utility bills for the common areas of the buildings and vacant apartments, but the tenants pay for their own spaces.

It chose to move forward, though, by targeting changes that would benefit the properties and the tenant. The roof retrofits, for example, help tenants heat and cool their spaces, but also extend the life of the roofs and their warranties. Replacing the appliances and water heaters have obvious direct benefits to tenants, but by doing the changes as green upgrades to Energy Star-rated versions, Southwest Housing was able to use grant funds from SmartBuildings Detroit and NeighborWorks America to mitigate the costs.

“The direct benefit is to the tenant more than us,” Pederson says, “but the side benefit is that because we are doing it as a green upgrade, we will save.”

In situations where retrofits are needed, but incentives may not be available, affordable financing becomes crucial. Yet, as Michigan Saves’ Schroeder explains, “The payback periods are generally longer in multifamily projects than lenders typically like to see.”

The Michigan Saves program lender has agreed to consider a repayment period of up to 84 months, enabling multifamily energy projects to move forward where traditional lenders might fall short. This financing unlocks projects that can improve comfort, reduce operating costs and increase the functionality of a multifamily building. Such improvements include common area lighting, heating and cooling, water heaters, air sealing, and insulation, Schroeder adds.

Jacob Corvidae, interim executive director of EcoWorks, a Detroit nonprofit that works to promote energy efficiency, has worked with many multifamily complexes, and has found that Michigan Saves not only provides funding that would not otherwise have been available, but simplifies the process for busy property managers.

“The big problem has always been coming up with the upfront cash, and that’s why the Michigan Saves program is so amazing because it addresses that concern,” he says.

Southwest Housing’s Pederson notes the shared opportunities of green investments: “The big thing for us was this dual opportunity to address upcoming expenses, but to do it in a greener way. It was attractive and exciting to marry those two together by stabilizing those buildings for years to come—and lowering expenses.”